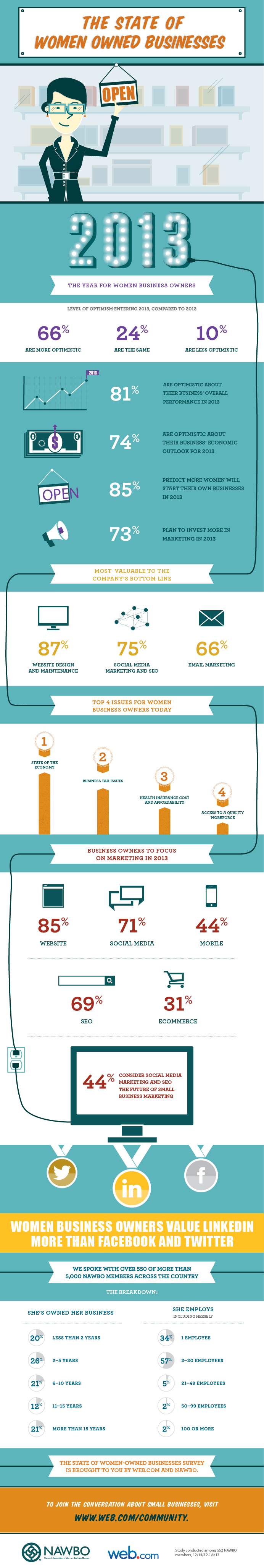

The Web.com and the National Association of Women Business Owners(NAWBO) recently published a report - The State of Women-Owned Businesses in 2013 - based on a survey of 500+ women business owners.

What Keeps Women Business Owners Up at Night?

With regard to public policy matters, the top four issues on the minds of WBOs are: the state of the economy (57 percent), health insurance cost and affordability (40 percent), business tax issues (36 percent), and access to a quality workforce (36 percent). Though two in five WBOs said that health insurance costs and affordability are important issues to them, many (71 percent) feel that the Patient Protection and Affordable Care Act (“Obamacare”) will have no impact upon the way they do business.

Finding New Customers through Online Investments and Social Media Marketing

When asked what they see as their biggest challenge to running their business in 2013, nearly two in five (39 percent) of WBOs said that it was gaining new customers. To gain customers, nearly three quarters (73 percent) of WBOs plan to invest more in marketing in 2013. Specifically, they will invest in social media marketing (36 percent) and search engine optimization (SEO) (36 percent). This is not surprising, as nearly half (44 percent) predict that social media and SEO are the future of small business marketing. Conversely, WBOs anticipated that traditional outreach approaches, including print and direct mail (1.6 percent), online advertising (4.4 percent) and email marketing (6.2 percent), will have less impact on small business marketing in the future.

Financing Options to Meet Business Capital Needs

More than three quarters (78 percent) of WBOs did not seek a new or extended line of credit in the past year. Of these 78 percent, more than half (68 percent) indicated they did not want additional credit in the first place, and the others (32 percent) did not think they could get credit if they tried. Most WBOs financed their businesses through credit cards (45 percent), business earnings (40 percent), or private sources such as personal savings or contributions from family or friends (37 percent).